Responsible accounting

If accounting students had to take an exam in recent accounting history, one of the exam questions could be this: “How did annual reports use to be submitted to the Tax Board?”

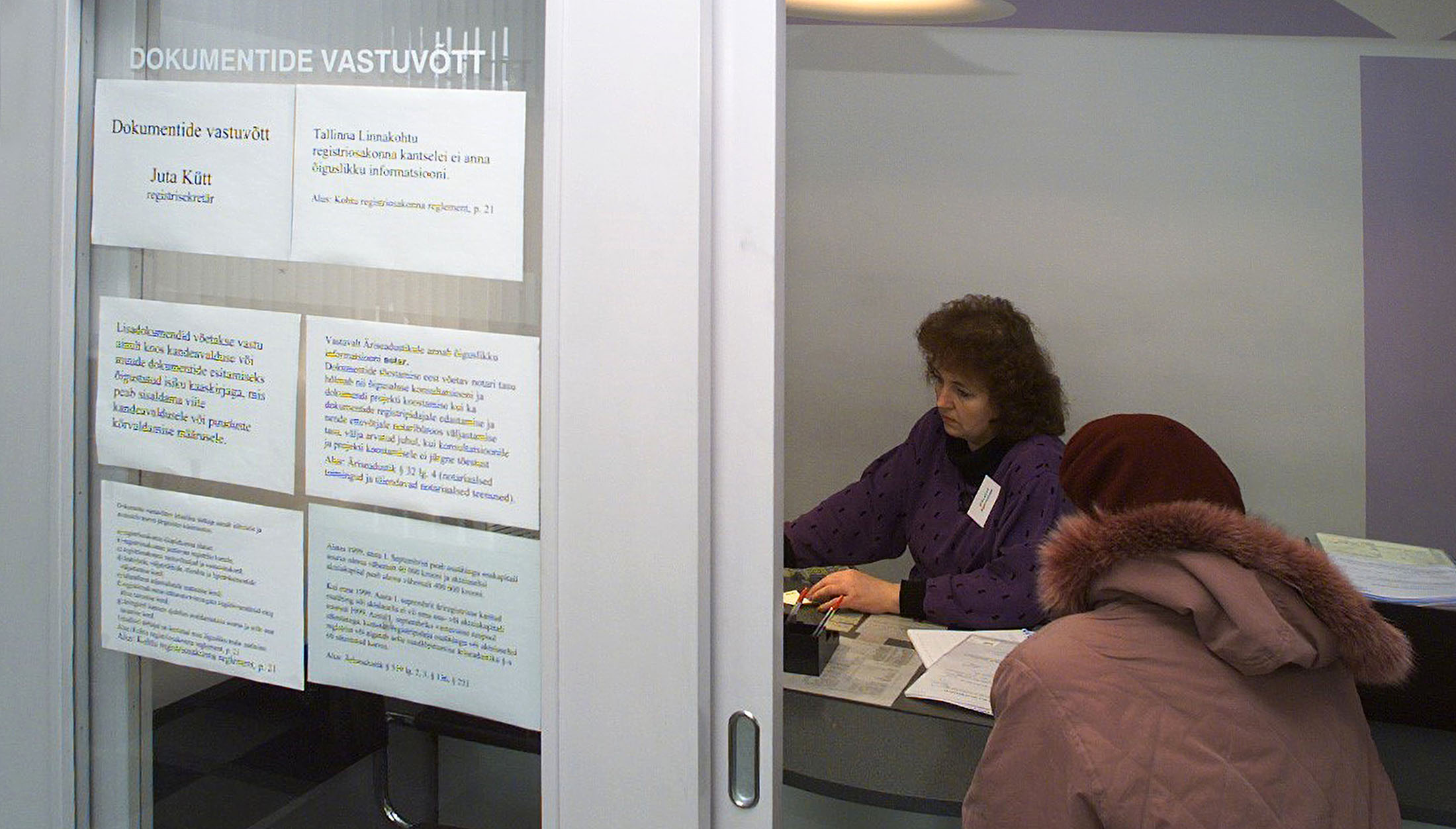

The right answer would be: “The report was on paper and had to be sent to the Tax Board by post or hand-delivered.” This was part of the day-to-day work of accountants in the 1990s and even in the early years of the 21st century.

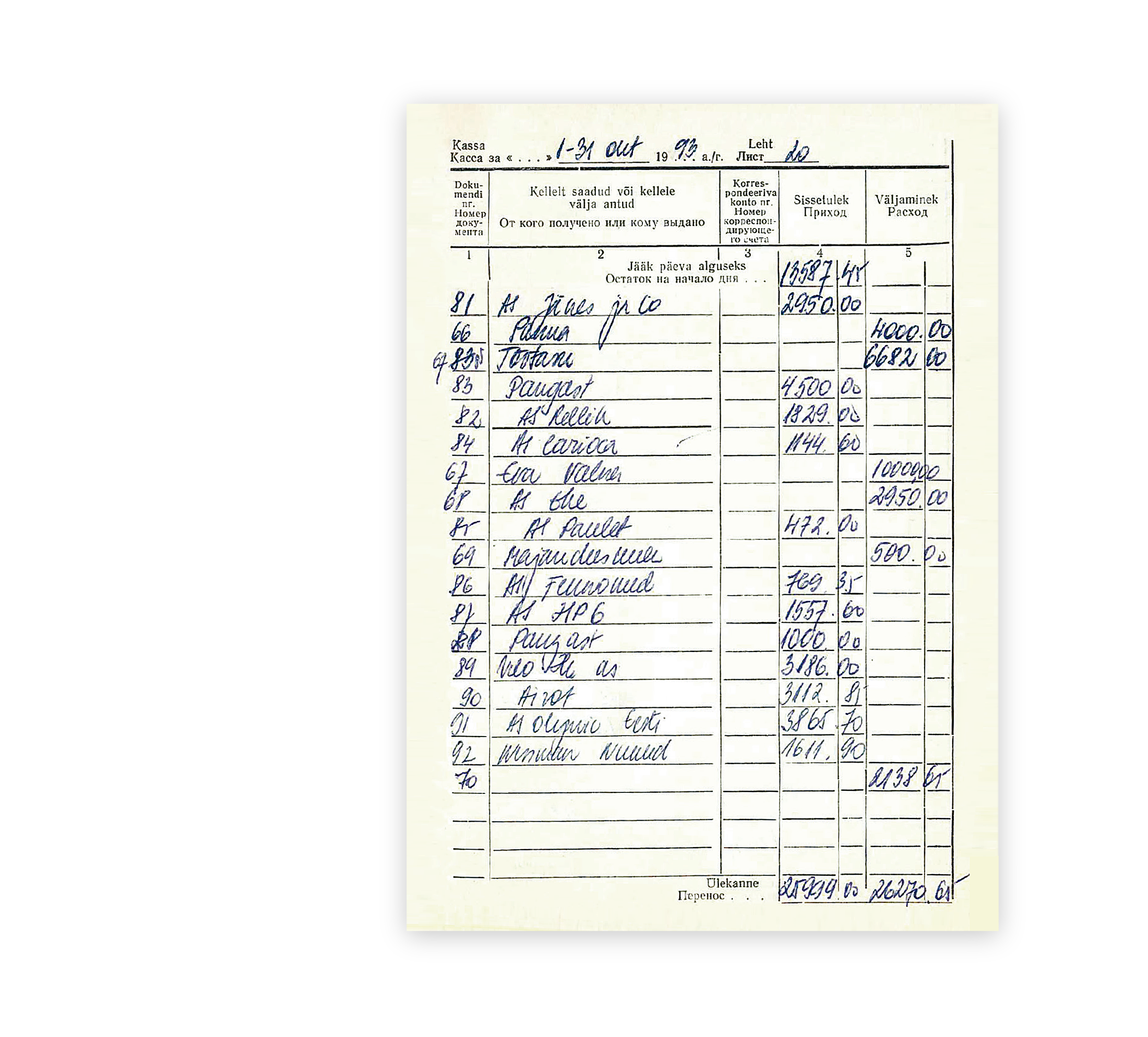

Nowadays, the idea of reports on paper seems bizarre and some accounting concepts, such as the Soviet-era system of journal orders, have been lost to history. However, when Rimess started operating in 1992, all of this was still the norm in Estonia.

Ene Rahula joined Rimess as an accountant in March 1993. She became the company’s fourth employee in addition to Mati Nõmmiste and two other accountants. Everything about Rimess felt new and modern to her, who had previously worked as an accountant at the Polümeer factory. Rahula recalls: “In Mati’s firm, a computer was used to do the accounts of clients and prepare reports, and there was accounting software – that was a big deal!” There were also clients who made sure everyone saw that they were keeping up with the times. Rahula remembers a client from the early years who always put their mobile phone on the table during meetings. At the time, the devices were quite bulky: more the size of a suitcase than a phone.

Although modern technological solutions were gradually introduced, this did not mean that paperless accounting was already within reach. On the contrary, the requirements at the time were that documents had to be on paper, so stacks of thick folders could be found everywhere. Of course, multiple copies of the tax returns and annual reports of clients had to be printed out and delivered to the Tax Board, and the Health Insurance Fund expected to receive sick leave certificates on paper as well. Documents were exchanged with clients by both snail mail and fax, and meetings were also quite frequent.